Ever feel like your money has a mind of its own, disappearing as soon as it lands in your account? Managing personal finances can feel like herding cats, especially with rent, bills, debt, and surprise expenses all vying for your attention. But that's where money apps come in! With just a few taps, you can track your spending, set budgets and even start investing - all from the comfort of your phone. Think of a money app as your personal finance sidekick, helping you keep every penny in line, build savings, and reach your goals faster. No spreadsheets, no stress, just smart money management.

Snoop:

Snoop is a UK-based money management app that brings a fresh, personalised twist to tracking your finances. Using clever insights (or “Snoops”), the app monitors your spending patterns and offers custom tips to save on everyday expenses, from switching utility providers to finding discounts on your favourite brands. It also categorises your transactions, helps manage subscriptions, and alerts you to any unusual activity across your accounts. Snoop also offers a ‘Plus’ version which is £4.99 a month, which allows you to do some cool things like create custom spending reports and alerts. Snoop’s AI-driven recommendations are designed to help you make smarter financial decisions and cut unnecessary costs, making it a handy sidekick for anyone looking to optimise their budget with minimal hassle.

Rating: 4/5 stars

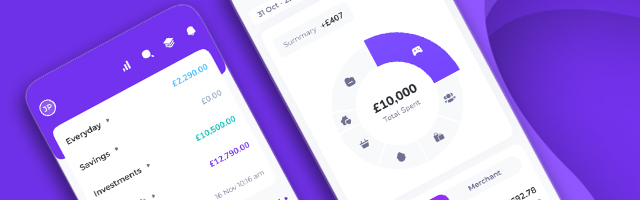

Emma:

Emma is a vibrant money management app designed to be your financial cheerleader! Known as the “financial advocate” in your pocket, Emma connects to all your accounts to give a clear, real-time view of your finances. With features like subscription tracking, personalised spending reports, and budget categorisation, Emma helps you stay on top of every penny and pound. It even identifies sneaky hidden fees and lets you set up custom alerts to avoid overspending. Emma has 4 different subscription options, free, Plus (£4.99/month), Pro (£9.99/month) and Ultimate (£14.99/month), you can find out more info on those packages here. With a friendly, interactive design, Emma turns budgeting into a manageable and even motivating experience, making it ideal for anyone looking to take charge of their finances with a bit of fun. Join now, right here!

Rating: 5/5 stars

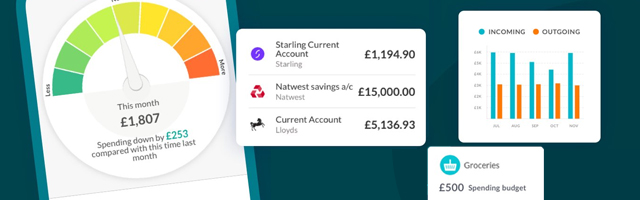

MoneyHub:

Moneyhub is a powerhouse personal finance app that puts all your finances in one place, making it easy to stay organised and informed. Designed with a holistic approach, Moneyhub links to bank accounts, credit cards, investments, and pensions, giving you a comprehensive view of your financial health. The app’s standout features include detailed spending analysis, personalised budgeting tools, and goal tracking, all aimed at helping you reach your financial milestones. Plus, with smart insights and even the ability to connect with financial advisors, Moneyhub is like having a financial coach on standby, making it a great choice for those serious about mastering their money!

Rating: 3/5 stars

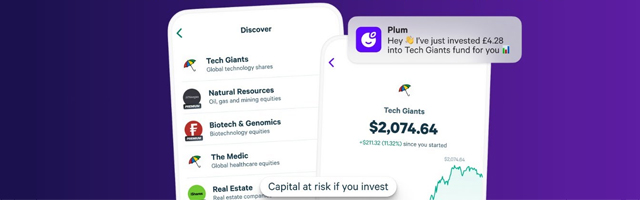

Plum:

Plum is a smart, AI-powered money app that’s like having a savings-savvy friend managing your cash flow. Designed to make saving and investing effortless, Plum connects to your bank accounts to analyse spending habits and automatically “squirrels away” small amounts without you lifting a finger. Plum’s standout features include automated savings, bill tracking, and even investing options, allowing you to grow your wealth in the background. You can also set up custom saving rules, like rounding up purchases or saving a little every payday. The basic version of Plum is free which gives you the perfect taster of how easy it can be to save. The premium version which has a whole host of extra features costs £9.99/month. With Plum, building your financial cushion becomes easy and even a bit fun.

Rating: 4/5 stars

Rise Up:

Rise Up is a unique finance app created with a mission to help you align your money with your values. Tailored for mindful spenders, Rise Up goes beyond tracking transactions, encouraging users to reflect on their financial decisions and connect them to personal goals and values. Key features include simple budgeting tools, spending insights, and journaling prompts to help you explore your financial habits and set meaningful intentions. RiseUp has 3 subscription options; ranging from £9.99/month to £7.99/month (billed annually at £95.99), all come with a free 7-day trial. Whether you’re aiming to save for something important or simply spend more consciously, Rise Up offers a fresh, supportive approach to personal finance that’s perfect for anyone looking to bring purpose to their spending.

Rating: 4/5 stars